Along with every other financial instrument led by the global stock markets, Bitcoin plummeted in the past two weeks following the worldwide spread of the coronavirus.

Following their desire to see Bitcoin emerging as the next generation’s safe-haven asset, this latest severe Bitcoin plunge felt like a nightmare for many Bitcoiners.

The following article will try to examine what led to the massive sell-off and will end in a little hope that Bitcoin might not have said its final word yet regarding its role in the monetary world.

Cash Is The Only Way To Buy Food And Medicine

Wall Street recorded some of its worst trading weeks; the main indexes are already 20-25% away from their all-time highs reached just a month ago. The hit was so intense that the New York Stock Exchange had to halt trading on a few occasions to minimize the damages, for the first time since 2008.

The drop didn’t skip the cryptocurrency market. Still generally accepted as a riskier investment, Bitcoin, and most coins, dropped by as much as 50% in a matter of days.

You Might Also Like:

- Coronavirus Madness Continues: Bitcoin Price Crashes Below $4300, Over 40% Daily Loss

- Trump Halts Flights From Europe: Stock Market Futures and Bitcoin Tumble

- Bitcoin Looking Healthy At $9,800 As Global Markets Tumble Amid Coronavirus Fears

The most brought up reason for those sell-offs is the basic human need for stable liquid assets – also known as cash. When the financial situation is at risk, people revert to a more state-of-survival mode. As such, they need to cover their essential needs, such as housing, food, and, yes, toilet paper. Investing is no longer a priority.

As of writing these lines, you can’t buy toilet paper or food with Bitcoin. Only with cash.

Among the sellers, there were large portions of institutional money. As the crypto community was blessing the institutional money and hedge funds that came to buy Bitcoin lately, we have to remember that they are buying Bitcoin for investment purposes only. These were also rushing to cash out their crypto portfolio along with their global market’s equities.

We Are Here For The Speculation

The cryptocurrency market is very young in the financial world. Additionally, it’s still relatively small, and there is no central authority behind it since Bitcoin is decentralized.

Thus, violent moves and fluctuations are a natural way of life for BTC, which also raises concerns among some investors about the value of their assets. This could also lead to mass sales in times of panic.

Besides, the list of Bitcoin leveraged trading exchanges, such as BitMEX and Binance Futures, has been continuously growing in numbers to cope with the increasing demand for speculative traders who want to utilize margin trading. As such, Bitcoin has become more of a speculative asset, instead of an actual “store of value.”

The effects are evident and received proof last week. While the price of BTC was tumbling, the Futures trading volume skyrocketed, ultimately leading to record-breaking liquidations. Such developments could quickly accelerate the price drop.

Interestingly, at the precise time of Bitcoin’s most severe drop to $3,600, BitMEX went offline due to “technical issues.” Yet, members of the community, including another popular exchange FTX asserted doubts if there were any technical problems at all.

The PlusToken $3 Billion Ponzi Scheme

This reason is actually not related to the coronavirus crisis; however, since the Bitcoin price was declining lately, it might have seen a boost in its selling process.

The PlusToken was a Ponzi scheme, which was abandoned in 2019. It was another classic pyramid scheme, just like Bitconnect.

The Ponzi promised its investors double-digits monthly returns; hence it was a matter of time until the fraudulent project, originated in China and Korea, had disappeared with the money.

The wallets of the company had cryptocurrencies worth over $3 billion on the date the project was abandoned. Later that year, and only recently, blockchain transactions proved that the founders are mixing their coins in order to sell them and cash out.

The most recent PlusToken transaction was on March 8, 2020, when 13,000 Bitcoins worth $105 million at that time were mixed in their way to be dumped on the market.

It’s still unknown whether the PlusToken founders had sold all their coins, however, eventually, it will end someday.

Not HODLing: Late Adopters – First Sellers

According to an ongoing investigation of blockchain transactions, many of the recent Bitcoin sales came from investors who have acquired the coins in the past 1-2 years. They are cashing out mostly in a loss. Human behavior is fed from the fear of losing some.

The HODLers have been around for many years and have experienced other significant price drops, such as the 2018 crypto bubble burst that brought the price of Bitcoin from a high of $20,000 to $3,200 in less than a year. The early adopters are aware that, generally, when Bitcoin goes down, it recovers over time.

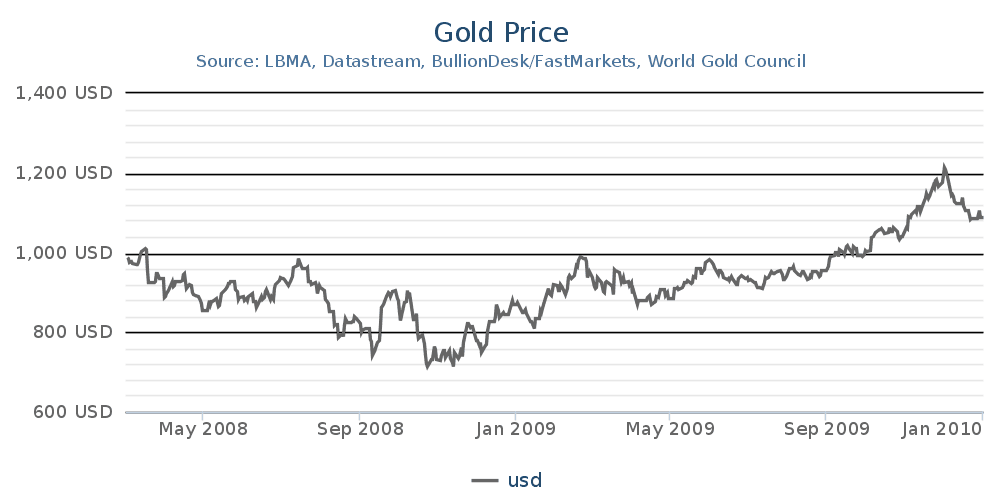

Gold’s Price Behaviour During the 2008 Financial Crisis

The precious metal is often regarded as the ultimate safe-haven asset. Consequently, it should have been performing rather well during the latest financial crisis, the Sub-Prime, one could assume.

The situation, though, is slightly more complicated. During the last global financial crisis in 2008, and more specifically in March that year, when the Federal Reserve had to rescue the corporate bank Bear Stearns, Gold exploded to over $1,000 per troy ounce. Later on, however, when the recession worsened, instead of continuing its decisive run, the precious metal tumbled.

Then, on Monday, September 15th, 2008, the crisis reached its climax when the U.S. bank Lehman Brothers filed for bankruptcy. In those six months, Gold plummeted to $775 and even lower in the following weeks. Only after the recession ended and investors returned to the markets, Gold’s price skyrocketed before it eventually exceeded $1,200 in January 2010.

None of the above, though, shook Gold’s perception as a safe haven. It only means that when push comes to shove, most investors panic sell their assets leading to price descends, and this includes Bitcoin and the other cryptocurrencies.

HODLers Hope: The Optimal Conditions For Bitcoin’s Explosion

Born dues to the 2008 recession, Bitcoin is yet to reach its real purpose. It’s supposed to be an electronic peer-to-peer cash system, but so far, it has been used mostly for a speculative form of investment.

All of this could change as quickly in case the people’s trust in the current banking system deteriorates. Banks were behind the 2008 recession mentioned above. Governments were forced to bail a lot of them out, but the mass opinion has already been shaken.

Today, the outbreak of the coronavirus seems like only the pin to pop the inflated bubble, which will expose many dirty secrets.

In a situation where banks will continue printing money, which will deflate its value, people might eventually start looking for alternative means of payments outside of governments and banks. That could be the glory moment Bitcoin had been waiting for.

However, this situation is far from reality, as of now, and no one guarantees the price of Bitcoin won’t continue to tumble even more.

Comments

Post a Comment